What to Do If the IRS Sends You a Letter (I Got One)

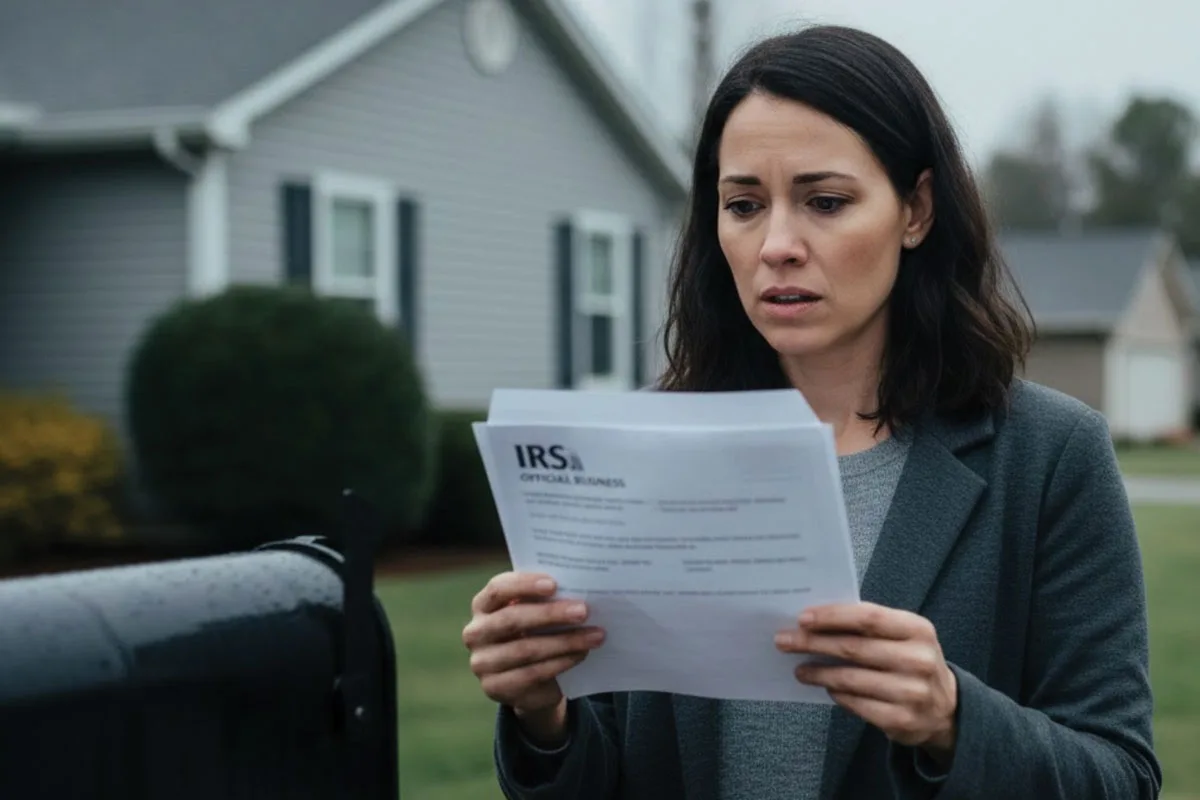

Receiving an IRS letter can feel overwhelming, but understanding what the letter means and knowing how to respond can turn a stressful tax warning into a manageable task. Don’t panic—this guide will help you decode that IRS letter and take the right steps with confidence.

Receiving official mail from the IRS can be an unsettling experience. It often triggers worry about potential problems with your tax filings or finances. However, not every communication from the IRS indicates a severe issue. Understanding the purpose of the IRS letter and responding appropriately can alleviate much of the stress and help resolve any concerns efficiently.

Understanding What an IRS Letter Means

The IRS sends letters or notices to taxpayers for various reasons, from simple confirmations to urgent tax warnings. An IRS letter is typically a written communication intended to provide information or request additional details related to your taxes. These letters might inform you of adjustments made to your tax return, request missing information, or alert you to a possible issue that needs addressing. It’s important not to ignore these letters because inaction can sometimes lead to penalties or more complicated problems.

Types of IRS letters include:

1. Information Requests.

The IRS may ask for clarification or notification about missing documents.

2. Notice of Adjustment.

Some letters indicate changes to your tax return, such as corrections to reported income.

3. Tax Warning Notices.

Messages that notify you about unpaid taxes or issues that could result in penalties or interest if not addressed promptly.

Recognizing the category your letter falls into is the first step in resolving any underlying concerns.

Need Cash to Help Cover Tax Bills?

Tax season can hit hard, especially when unexpected bills pop up or your refund isn’t as big as you hoped. If you need a little extra money to stay ahead, a small side stream of income can make a big difference. From quick surveys to simple online tasks to apps that pay for your time, these are some of the easiest ways to earn fast cash when tax pressure is high.

| Offer | Earning Potential | Task | Don’t Miss Out |

|---|---|---|---|

InboxDollars |

$225/month | Complete Surveys | Get Started |

FreeCash |

$1,000/month | Simple Online Tasks | Get Started |

GoBranded |

$140/month | Share Your Opinion | Get Started |

Kashkick |

$1,000/month | Try Out Apps | Get Started |

Solitaire Cash |

Up to $83 per win | Compete against players | Download Now |

Bingo Cash |

Up to $83 per win | Compete against players | Download Now |

Step-by-Step Actions to Take After Receiving an IRS Letter

1. Carefully Read the Letter

Before doing anything, read the IRS letter thoroughly. IRS communications generally include specific information such as your taxpayer identification number, the tax year concerned, and details about the reason for the letter. Take note of any deadlines, requested actions, or contact information. Understanding the exact nature of the letter can guide your next steps.

2. Verify Its Authenticity

Unfortunately, scammers sometimes send fake IRS letters to trick taxpayers into sharing sensitive personal or financial information. To protect yourself, verify the authenticity of the letter. Genuine IRS correspondence usually includes a notice number, a phone number you can verify on the official IRS website, and clear references to your filings. If in doubt, call the IRS directly using the phone number listed on their website, not the number on the letter.

3. Do Not Ignore the Tax Warning

If your letter is a tax warning, warning you about possible penalties, unpaid taxes, or errors, take it seriously. Delays in responding could increase the amount you owe or cause the IRS to take enforcement action, such as liens or levies. Addressing these issues proactively often reduces your overall financial burden and avoids further complications.

4. Gather Relevant Documents

To respond adequately, gather any tax returns, receipts, or documents referenced in the letter. You may need these to verify information, provide proof, or explain discrepancies. Organizing your paperwork before contacting the IRS or a tax professional can streamline the process.

People Aren’t Relying on Their Tax Refunds Anymore

They’re boosting their cash flow now (see how they do it).

How to Respond to an IRS Letter

Depending on the content of the letter, your response might differ:

1. If the letter requires additional information.

Provide the requested documentation promptly and clearly. Attach copies (never originals) and include any required forms or statements.

2. If the IRS made an adjustment you disagree with.

You have the right to dispute it. Respond with a written explanation and evidence supporting your position. You might also consider consulting a tax professional.

3. If the letter warns about unpaid taxes.

Pay any amounts owed by the deadline if possible. If you can’t pay in full, the IRS offers payment plans or may accept an offer in compromise that settles the debt for less than the full amount.

When to Seek Professional Help

If the IRS letter is complicated, involves a large sum, or you’re unsure how to proceed, consulting a tax advisor or certified public accountant is wise. Tax professionals have experience navigating IRS communications and can help you respond appropriately while minimizing potential negative outcomes.

Preventing Future IRS Letters

While some IRS letters are unavoidable, you can reduce the likelihood of receiving tax warnings or requests by:

1. Filing accurate and complete tax returns.

2. Paying taxes on time or setting up payment plans in advance if needed.

3. Keeping thorough records of income, deductions, and relevant documents.

4. Responding timely to any IRS correspondence.

Final Thoughts

Receiving an IRS letter might cause anxiety, but it doesn’t automatically mean bad news. The key is to read the letter carefully, understand what is being requested or warned, and respond promptly and accurately. Being proactive helps you resolve issues quickly, avoid penalties, and maintain good standing with the IRS. Remember that help is available if you feel overwhelmed, and addressing the issue early reduces stress and financial risks.

I Compared My Insurance Rates After Years — The Difference Shocked Me

I Compared My Insurance Rates After Years — The Difference Shocked Me