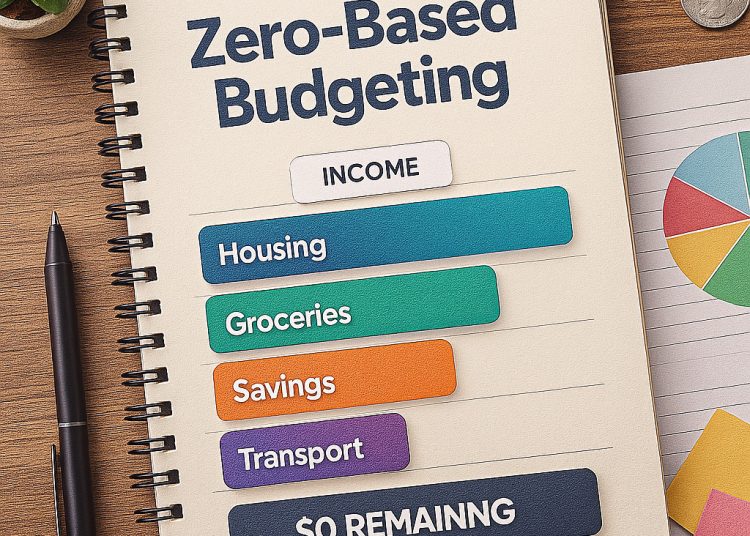

Zero-Based Budgeting Explained: Must-Have Tips for Best Results

Zero-based budgeting is a financial planning method that requires you to start from scratch for every budgeting cycle. Instead of using previous budgets as a base, it demands a fresh evaluation of all expenses and the justification of each dollar planned to be spent. This hands-on approach ensures tighter control over finances and aligns spending with actual priorities, making it a powerful tool for individuals, households, and businesses aiming for disciplined money management.

What Is Zerobased Budgeting?

At its core, zero-based budgeting flips the traditional budgeting method on its head. Typically, budgets are drafted by taking last year’s numbers and adjusting them slightly. In contrast, zero-based budgeting requires you to justify every expense starting from zero, making no assumptions based on past expenditures.

This technique originated in the corporate world but has gained popularity among personal finance enthusiasts for its ability to foster mindful spending. Every budget cycle—monthly or quarterly—the budgeter must analyze every item, question its necessity, and ensure that spending aligns with current goals.

How Zerobased Budgeting Works

The zero-based budgeting process can be broken down into a few key steps:

1. Identify Income: Determine all sources of money that will be available during the budget period.

2. List Expenses: Enumerate every possible expense, from rent and groceries to entertainment and savings goals.

3. Justify Every Expense: For each item, explain why it is necessary. If an expense cannot be justified, it is eliminated or reduced.

4. Allocate Funds Accordingly: Assign available funds to each verified expense until your total income is fully accounted for.

5. Monitor and Adjust: Throughout the budget period, track actual spending and make real-time adjustments if required.

This method ensures that all money has a purpose, often summarized as “giving every dollar a job.”

Benefits of Zerobased Budgeting

Zero-based budgeting offers several distinct advantages:

– Greater Financial Awareness: By evaluating every expense, you become acutely aware of where your money is going.

– Elimination of Wasteful Spending: Unnecessary or outdated expenses are easily spotted and cut.

– Improved Cash Flow Management: Knowing exactly what you need each month helps avoid overspending.

– Aligns Spending with Goals: Resources are intentionally directed toward priorities, such as debt payoff or emergency savings.

– Encourages Accountability: Every dollar is accounted for, which fosters responsible money habits.

Must-Have Tips for Zerobased Budgeting Success

Adopting a zero-based budgeting approach can initially feel daunting. Here are some practical tips to help you maximize results:

1. Start With Clear Financial Goals

Define your short-term and long-term financial objectives before you start budgeting. Whether it’s saving for a vacation, paying off credit cards, or investing for retirement, clear goals help prioritize spending and provide justification for expenses.

2. Be Thorough and Honest

When listing expenses, don’t overlook small or irregular expenditures such as subscriptions or occasional outings. Honesty is critical—disguising or ignoring certain costs defeats the purpose of zero-based budgeting.

3. Use Budgeting Tools or Apps

Leverage technology to simplify the process. Budgeting apps tailored to zero-based budgeting can automatically categorize expenses and help keep your budget balanced, making it easier to manage over time.

4. Schedule Regular Budget Reviews

Zero-based budgeting requires discipline and consistency. Set aside time weekly or monthly to review your budget versus actual spending. This reflection ensures you stay on track and make timely adjustments.

5. Allow Flexibility for Unexpected Expenses

While zero-based budgeting requires justification for every expense, life is unpredictable. Build an “emergency” or “miscellaneous” category to accommodate unforeseen costs without disrupting your entire plan.

6. Communicate If Budgeting for a Household or Business

When managing money that affects others, like family or teams, involve key stakeholders in the budgeting process. Transparency helps gain buy-in and encourages collective responsibility toward financial goals.

Common Challenges and How to Overcome Them

Many people find the initial phase of zero-based budgeting time-consuming because it demands zero assumptions and meticulous planning. To counter this:

– Break down budgeting into smaller chunks, focusing on one category at a time.

– Automate tracking by syncing your bank accounts with finance software to reduce manual entry.

– Recognize that the effort is front-loaded—after a few cycles, the process becomes easier and more intuitive.

Also, psychological hurdles can crop up, such as guilt over cutting expenses or fear of strict budgets. Keep focused on the benefits and treat the budget as a flexible guide, not a rigid rulebook.

Who Should Use Zero-Based Budgeting?

While zero-based budgeting is beneficial to most people, it’s especially suitable for:

– Individuals with Unpredictable Income: Freelancers or commission-based workers can better align expenses with fluctuating earnings.

– Those Facing Financial Challenges: If debt or overspending is a concern, this method can enforce discipline.

– Businesses Wanting Cost Control: Companies can rationalize project expenses and eliminate redundancies effectively.

However, if your finances are straightforward or your income is stable and predictable, a simpler budgeting method might suffice.

Final Thoughts

Zero-based budgeting offers a fresh perspective on financial planning. By scrutinizing every expense and tying spending directly to income, it helps build purposeful financial habits. Embracing this budgeting style requires commitment, but with clear goals, honesty, and the right tools, you can achieve better financial control and peace of mind. If you’re serious about making the most of every dollar, zero-based budgeting is a strategy worth exploring.